How to Guide: Centrix Credit Report

The Centrix Credit Report is a very powerful tool in making lending decisions. It is a culmination of all the information Centrix has about a person as well as checking several external databases to add even more information to the dataset. With this information in your hands you can make a clear, informed decision about the risks of lending to an individual.

finPOWER Connect allows you to interface with Centrix without having to purchase any additional modules and brings the power of the Centrix Credit Report directly into finPOWER Connect. Once a Credit Report has been completed, the Report is automatically stored against the client for easy access in the future.

Centrix holds credit information on over 3.4 million New Zealanders. Comprehensive Credit Reporting (CCR) is gaining momentum, with 23 providers of data participating already. Centrix holds CCR data on 2.95 million New Zealanders, and with several more credit providers in project to participate, this number is growing fast.

Centrix Credit Reports are:

- Fast and Efficient

- Comprehensive

- Include Predictive scores

- Cost Effective

- Delivered straight to your finPOWER Connect desktop

The Recommended Retail Price for the Centrix Credit Reporting Suite are:

| Consumer Credit Report including: | |

|---|---|

| Credit File details (enquiries, defaults) Court Fines Data Property Ownership Records Companies Office Records Name Only insolvency CCR Data (if Registered) | $6.00 plus GST |

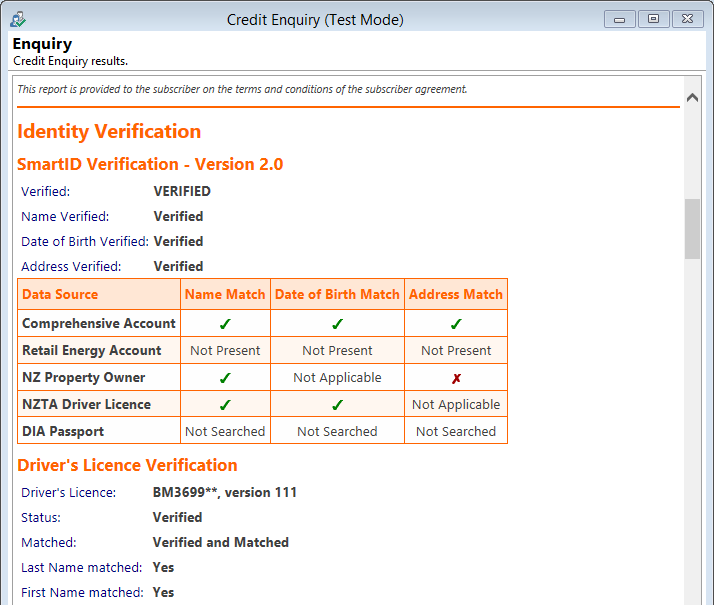

In addition to risk assessment, Centrix can also assist with your AML requirements. Their SmartID suite of products allows to confirm the identity of a person by verifying their Drivers Licence or NZ Passport and a range of other information sets.

Smart ID – Electronic ID Verification to assist meeting your AML requirements:

| Smart ID Verification, including: | |

|---|---|

| Bureau ‘trusted source’ File check (CCR, Retail Energy) Property ownership PEP/Sanctions (Thompson Reuters) | $2.75 plus GST |

| Smart ID plus Driver Licence Verification | $2.75 plus GST |

| Smart ID plus NZ Passport Verification | $4.40 plus GST |

To Configure your Centrix Account

You must have a registered Centrix Account. If you do not already have an account, click here.

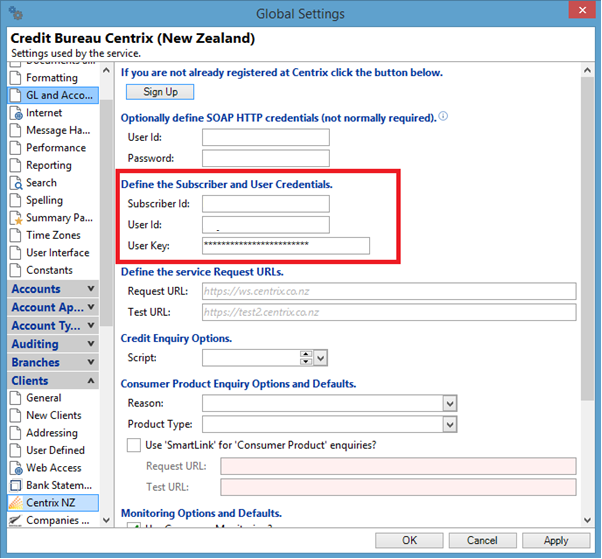

Once you have your Centrix Account, enter your Subscriber ID, User Id and User key into Tools, Global Settings, Clients, Centrix NZ.

To initiate a Credit Report

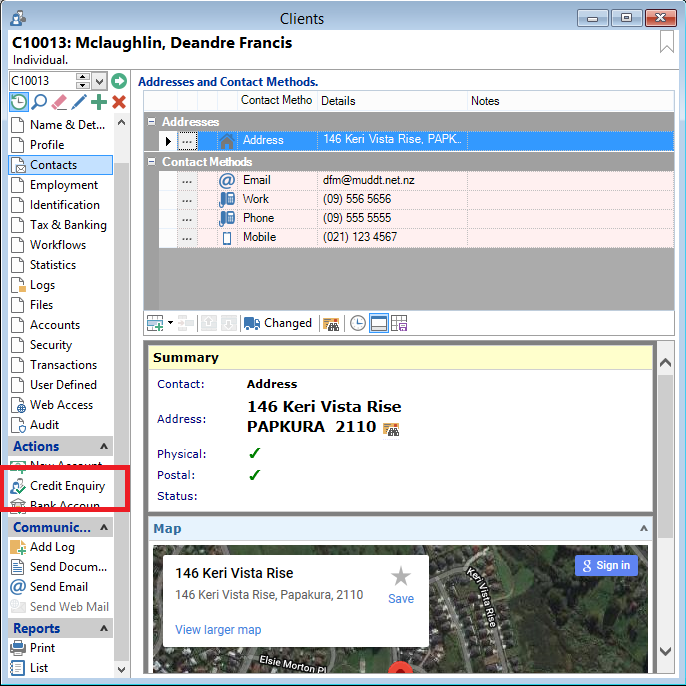

From the required Client select Credit Enquiry from the Actions Menu Bar.

Alternatively you can also access the Credit Enquiry Request Form from:

- Clients, Credit Enquiry

- Workflow items

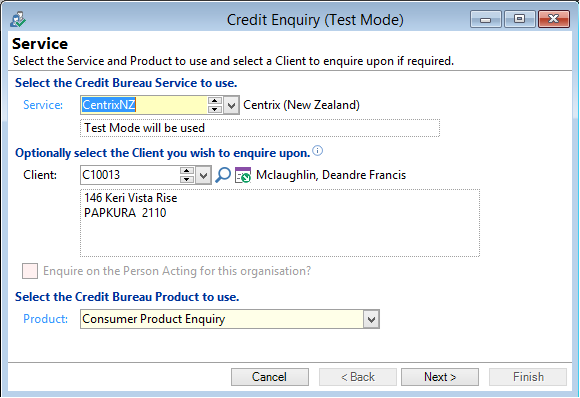

The Credit Enquiry Request Form

The Client will be defaulted if you have initiated the Credit Enquiry from the Client screen or a workflow, but it can be left blank if you want to manually enter to individual’s details.

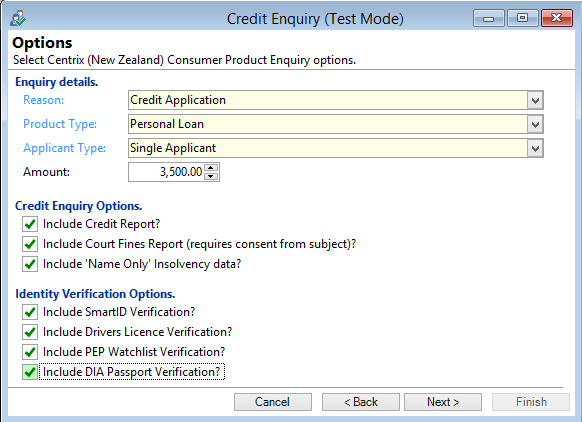

From the Credit Enquiry Options, select the information you want to see on the Report.

- Include Credit Enquiry includes the standard Centrix Credit Report

- Include Court Fines Report includes any paid or outstanding Court fines the individual may have

- Include Name Only Insolvency data includes a check against Insolvency Records using only the Client's Name

If you want to verify the individual's identity using the Smart ID service from Centrix, select the required options:

- SmartID Verification includes:

- Bureau 'trusted source' File check (CCR, Retail Energy)

- Property ownership

- PEP/Sanctions (Thompson Reuters)

- Driver Licence Verification allows you to check the entered Drivers Licence details against the NZTA database

- PEP Watchlist Verification check the individual against the PEP (Politically Exposed Persons) register

- DIA Passport Verification checks the supplied NZ Passport details against the DIA (NZ Department of Internal Affairs) database

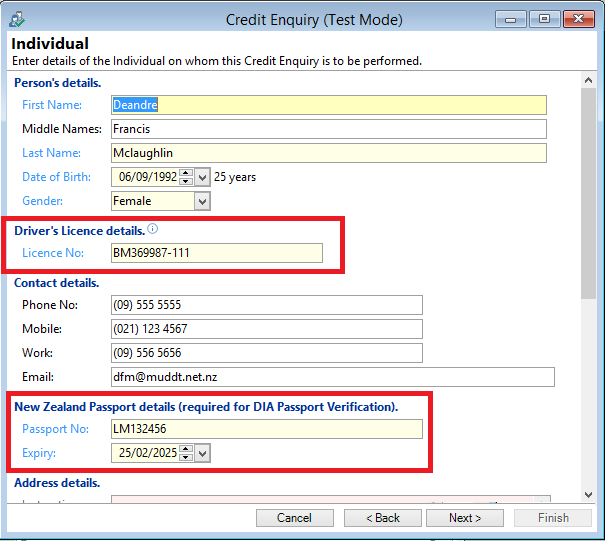

Click Next and enter the relevant details if they have not already been completed. The Drivers Licence and Passport details will be pre filled from information you have previously entered into the Identification Page on the Client file.

Note; you would generally only select one of Driver Licence or Passport Verification.

The Credit Report Explained

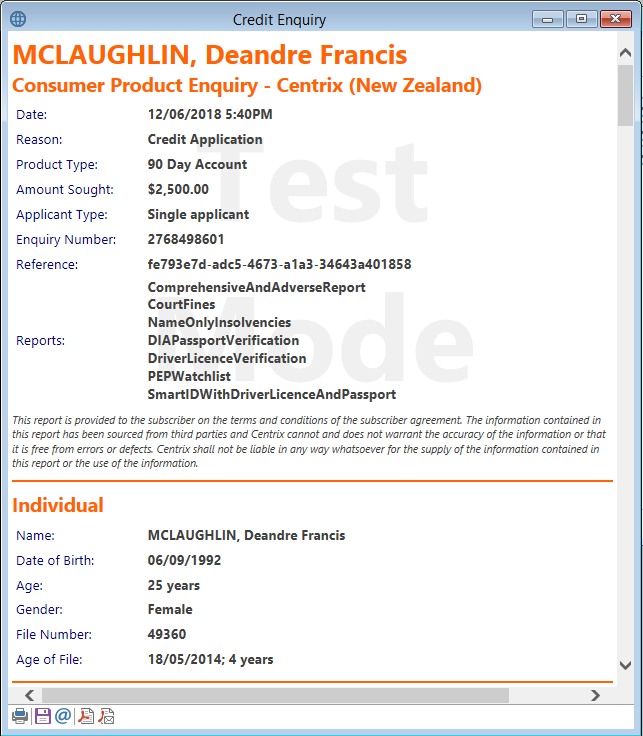

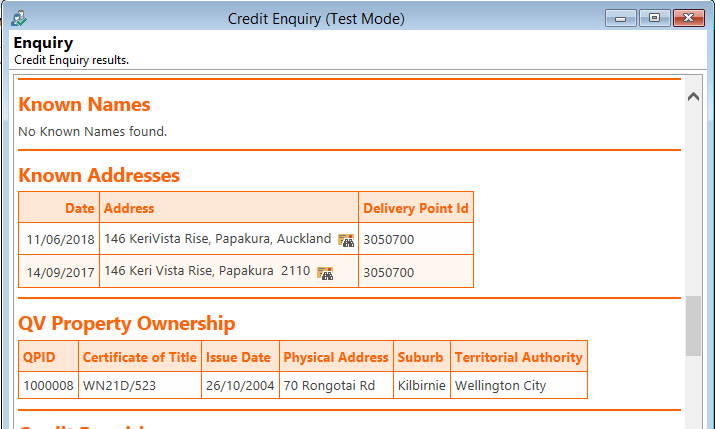

The first section of the credit report confirms the details you submitted and lists the reports that go to make up the Credit Report. It also confirms the Client’s details and the age of the File (how long Centrix has had a file on the individual).

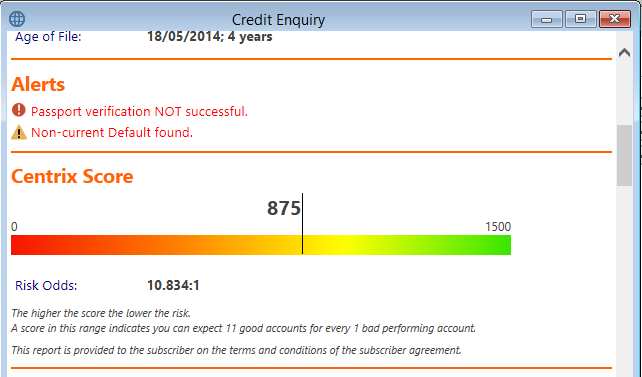

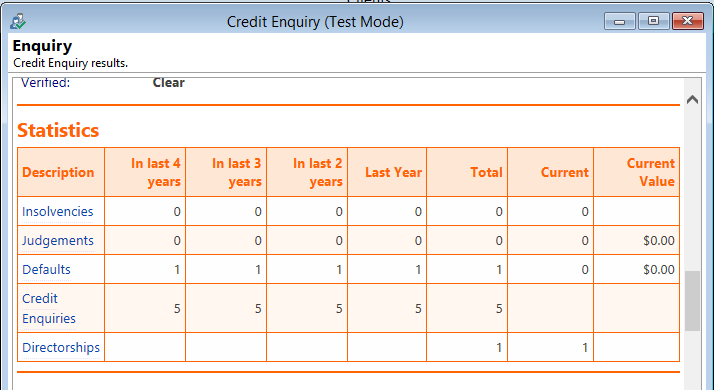

The Risk Odds score is a measure of what is the likelihood of an account for this client going bad. In the example below there is a 1 in 11 chance of an account going bad – obviously the higher the Risk Odds Score the better.

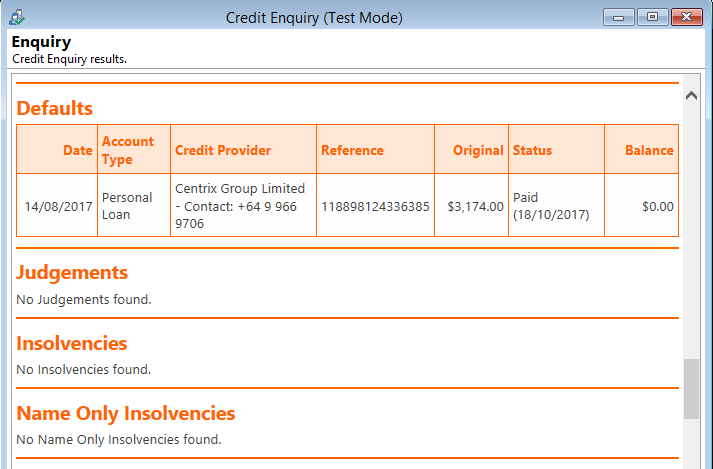

Any defaults loaded on the Bureau are detailed including Defaults that have been fully paid. Specific details on negative Credit Data are provided as well.

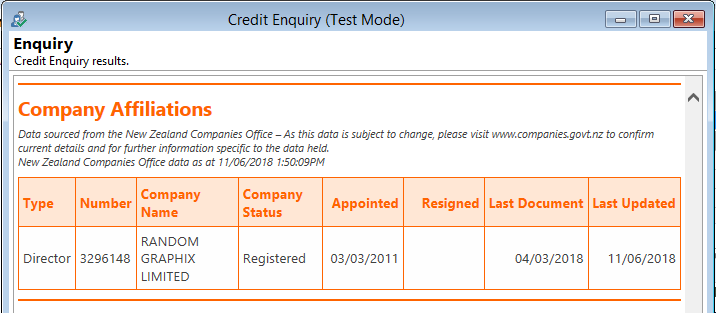

If the individual is associated with any companies, either as a Director or Shareholder, Centrix interrogates the Companies office and reports the information back in the Credit Report.

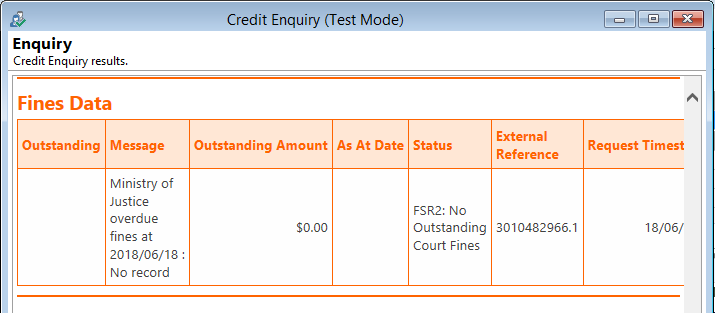

Likewise, any Court Fines are investigated by Centrix and detailed in the Credit Report.

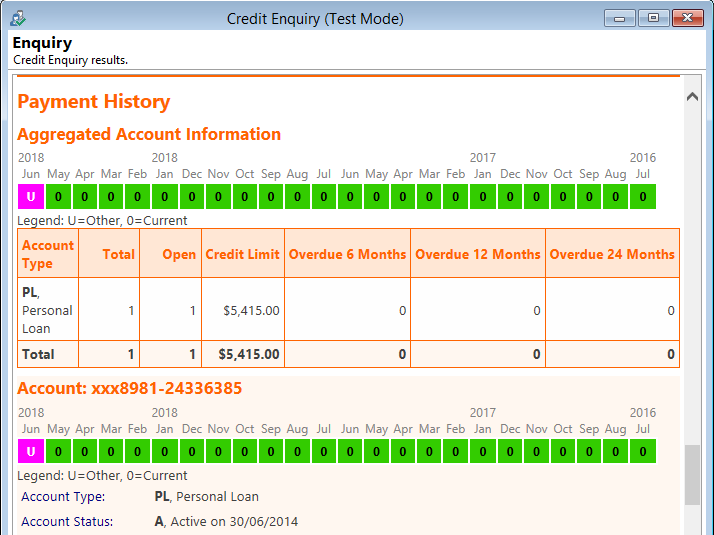

If you are registered with Centrix and are providing Comprehensive Credit Data, then your Credit Report will include the Payment History of all other loans and credit accounts supplied by other Credit Providers under the CCR framework. The Aggregated Account Information section summarises the payment history of all the Credit Accounts Centrix has CCR data on and then each Credit Account is detailed individually.

The CCR Payment History data is invaluable for providing clarity in making your lending decisions. Being able to clearly view an individual’s payment performance across a broad spectrum of lenders and utility providers allows you to better evaluate the most recent payment history for an individual and better assess their ability to repay a new loan.